It’s [John Doe], your [Company Name] agent. Your insurance renewal is coming up and I wanted to get in front of it. First thing’s first: If you haven’t reviewed your policy with my agency in a while, I invite you to do so. Not only that, I encourage It. We can almost always find a way to bring some costs down.

I will even give you a few options because I know you are probably pretty busy.

If you want to go down the rabbit hole with me continue reading.

If you want to know a little more about what is going on in the insurance industry, I’ll give you a few highlights, or lowlights is probably more accurate. I have been an agent for [19] years. We have enjoyed average rate increases of 0-5% for most of those years. The last two years, have been extraordinary.

Why are rates doing this? Covid started everyone down a pretty dark path. The path led to inflation like we haven’t seen in a couple of generations. Insurance costs are based off of what it costs to fix things (cars, houses, people). To help you begin to understand, I would ask you two questions: 1. What did your house cost to build when it was built? 2. What would it cost to build now?

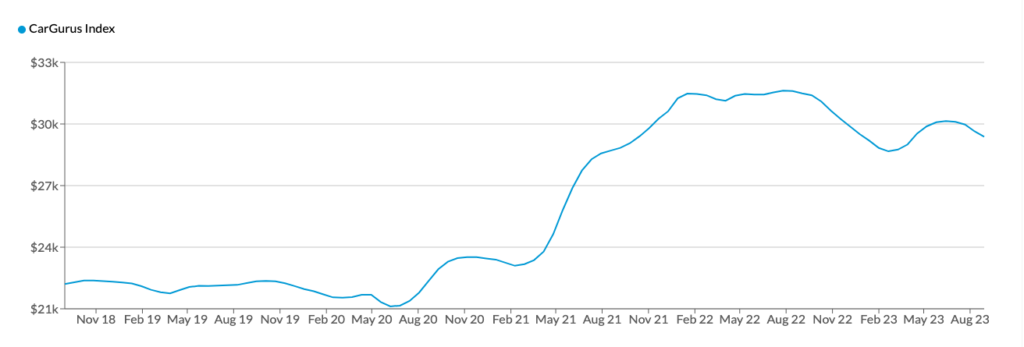

A water leak that leads to some flooring and drywall damage that 5 years ago cost $7,500, now will cost $13,000. We just replaced a windshield for $1,124! The cost of an average USED car is almost $30,000.

Couple this with the number of catastrophic claims ($25,000,000 or more per event) increasing 250% in the country over the past two years, it creates a recipe for uncomfortable increases. Entire towns are burning down, like Lahaina and Paradise. Storms are bigger and more frequent. Fires are more fierce and widespread.

We want to help alleviate this as best we can for you. Please reach out with any questions you have, schedule a time for a review or let us look at if for you and we will send you recommendations.

Thank you so much for your business. We greatly appreciate your support.

Sincerely,

[John Doe]

[ABC Company]